Category: Asset Protection

-

The RMD Advantage: A Smarter Strategy for Washington & Idaho Retirees

Required Minimum Distributions don’t have to be a burden. Learn how savvy Washington and Idaho retirees are transforming their RMDs into a powerful retirement advantage, potentially increasing income while maximizing tax-deferred growth. Discover a strategic approach that helps protect your retirement savings from market volatility and unnecessary taxes.

-

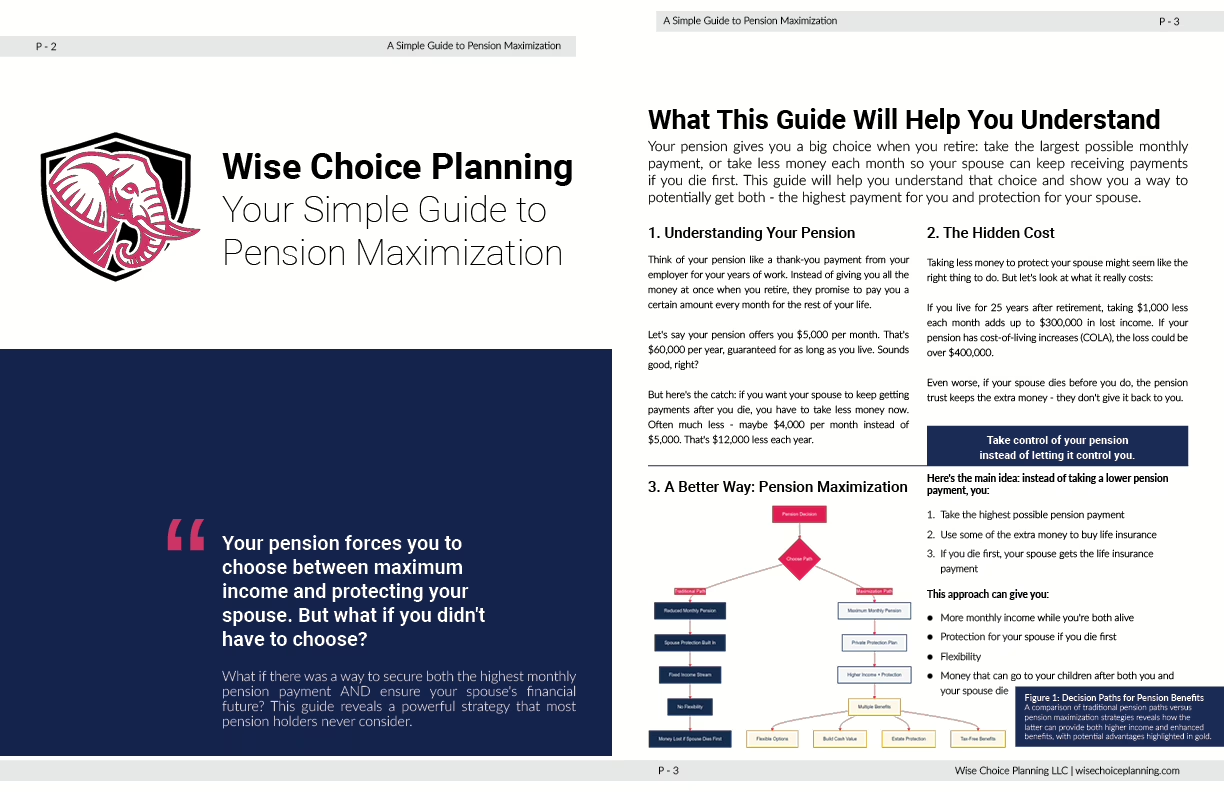

The Pension Triple Play: A Washington Retiree’s Guide to Having it All

Learn how to maximize your Washington state pension income, protect your spouse’s future, and build family wealth through our innovative pension triple play strategy. Get 22% more monthly income on average.

-

Maximizing Your Financial Future: IRS Section 7702 and Indexed Universal Life Insurance

Discover how to leverage IRS Section 7702 and Indexed Universal Life insurance for tax-advantaged growth, flexible retirement income, and robust asset protection.

-

IRS Section 7702: Your Key to Tax-Advantaged Defensive Asset Protection

Discover how IRS Section 7702 can enhance your defensive asset protection strategy. Learn about tax-free benefits, income protection, and wealth preservation with Wise Choice Planning.

-

Defensive Asset Protection: Safeguarding Your Financial Future in Uncertain Times

Discover how defensive asset protection strategies can secure your financial future in uncertain times. Learn key approaches with Wise Choice Planning for long-term financial security.

-

Monthly Insights & Tidbits: The Elephant in the Room

Welcome to the second edition of our Monthly Updates, Insights & Tidbits from Wise Choice Planning, LLC. Our mission is to provide you with valuable insights that spark questions about your current defensive asset and income protection plan.

-

Monthly Updates, Insights & Tidbits: Fortifying Your Financial Future

Welcome to the inaugural edition of our Monthly Updates, Insights & Tidbits from Wise Choice Planning. Our goal is to provide you with valuable insights and information to spark questions about your current defensive asset protection plan.