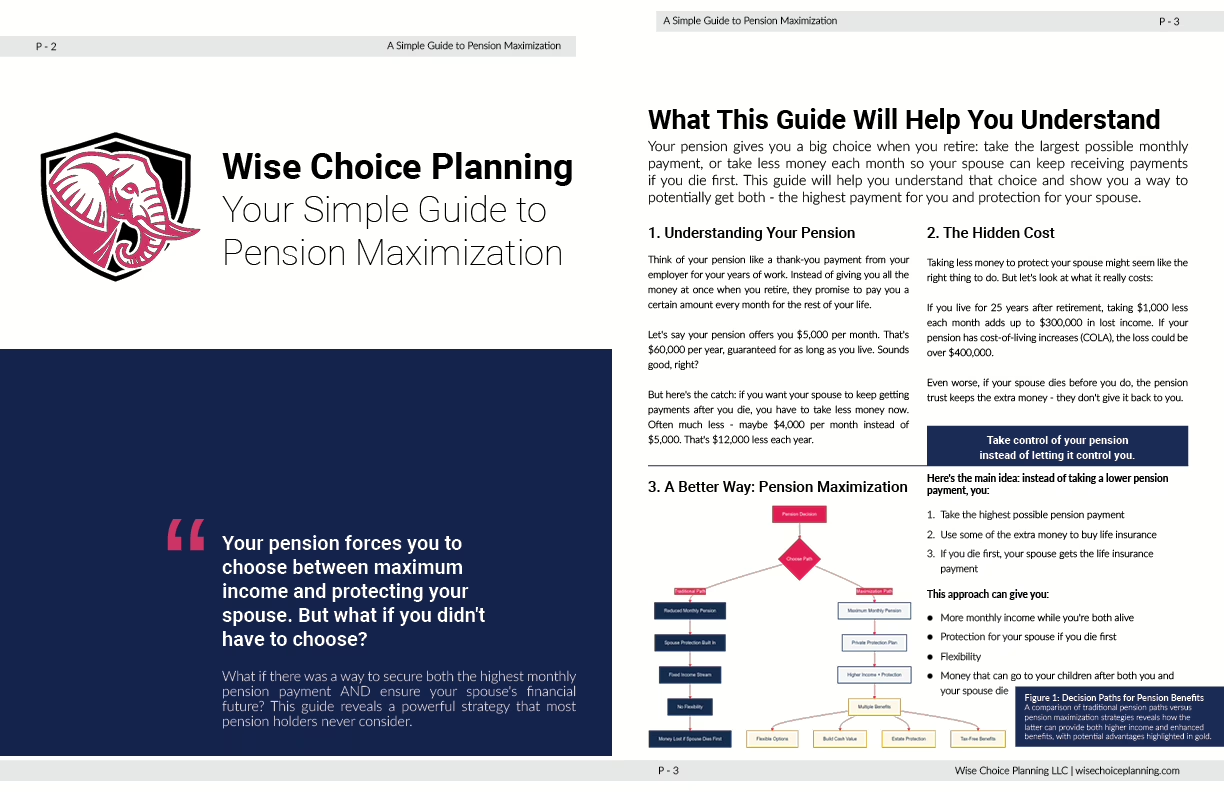

Don’t sacrifice your pension income to protect your spouse

Most pension holders face an impossible choice: take the highest monthly payment but leave their spouse vulnerable, or accept a lower payment to protect their family. This guide reveals a proven strategy to secure both.

Why this matters

When choosing your pension options, seemingly small decisions compound into life-changing amounts. Many retirees unknowingly leave hundreds of thousands on the table. Let’s make sure you don’t.

The hidden cost of your pension decision

Your pension forces you to choose: maximum monthly income or spousal protection. But this stark choice overlooks a powerful strategy that could help you secure both. Discover how public employees across Washington have protected their families while maximizing their retirement income.

From someone who’s been there

“After two decades in banking and financial planning, I’ve guided hundreds through strategic financial decisions. I wrote this guide because I’ve watched too many capable professionals lose substantial wealth through simple misunderstandings.”

Get the guide before making your pension election.

Your privacy matters. We never share your information.

Leave a Reply