Beyond Basic Savings: Our Comprehensive Approach to Retirement Security

At Wise Choice Planning, we understand that your retirement years should be a time of financial security while embarking on the adventure of a lifetime. Our professional financial advisors employ advanced retirement planning strategies to help your future be filled with excitement, new experiences, and the freedom to pursue your passions.

Our comprehensive approach to retirement preparation goes beyond basic savings plans. We employ advanced techniques to maximize your income streams, safeguard your hard-earned wealth, and create a robust financial foundation that can weather economic uncertainties.

Advanced Retirement Income Strategies

Whether you’re just starting to think about retirement or you’re on the cusp of this exciting new chapter, our tailored strategies are designed to optimize your financial resources and help your retirement dreams become a reality.

Social Security Benefit Review and optimization

We analyze your Social Security benefits to determine the optimal time to claim, maximizing your lifetime payout. Our professionals consider factors such as your work history, life expectancy, and overall retirement strategy to help you make informed decisions about this crucial retirement income source.

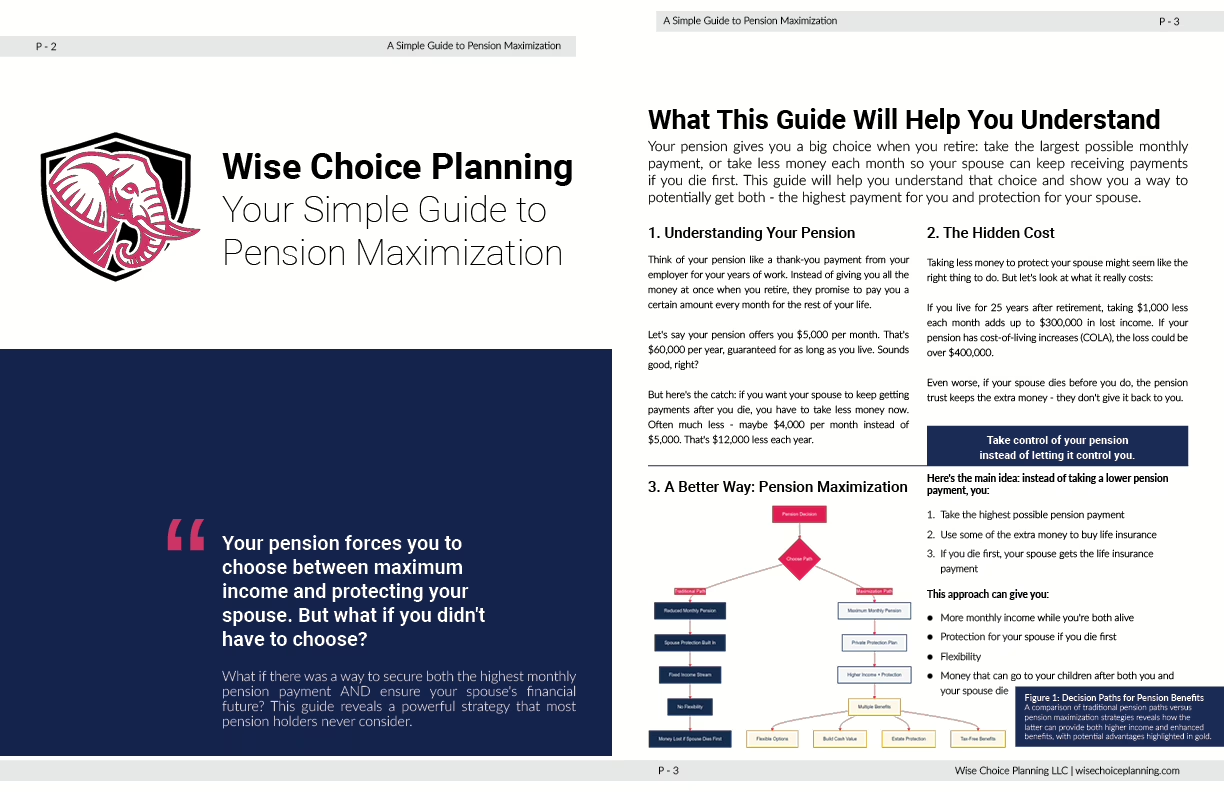

Pension option planning: Creating your own private protection plan

For those with employer pension benefits, we develop strategies to optimize your payout options. We help you create a personalized protection plan that balances your need for immediate income with long-term security to enhance your employer pension benefits.

Maximization of guaranteed lifetime income

We explore various avenues to help secure reliable, guaranteed income streams that last throughout your retirement. This may include annuities and other financial products designed to provide steady, lifelong income.

Exploring Life Insurance Retirement Plans (LIRPs)

LIRPs offer a unique combination of life insurance protection and tax-advantaged retirement savings. We help you understand how these plans work and determine if they fit into your overall retirement strategy, potentially providing both financial security for your loved ones and a source of tax-free retirement income.

Don’t leave your retirement to chance. Our professional advisors are here to help you navigate these advanced strategies and create a personalized plan that fits your unique needs and goals.

FAQ: Retirement Planning Strategies

When should I start planning for an active retirement?

It’s never too early to start planning for your dream retirement. The sooner you begin, the more opportunities you’ll have to create the lifestyle you desire.

How much money do I need to fund an adventurous retirement?

The amount needed varies based on your desired lifestyle and planned activities. Our retirement planning professionals can help you calculate a personalized savings goal to support your unique retirement vision.

Can I really afford to travel and pursue new hobbies in retirement?

With proper planning and the right strategies, many retirees can afford an active, adventure-filled lifestyle. We can help you develop a plan to make your retirement dreams a reality.

How can I ensure my retirement savings last through years of active living?

We offer various strategies, including guaranteed income plans and smart withdrawal techniques, to help ensure your savings support your lifestyle throughout retirement.

What if my idea of an ideal retirement changes over time?

Our retirement plans are flexible and regularly reviewed. We can adjust your strategy as your goals and dreams evolve, helping ensure your financial plan always aligns with your vision for retirement.

Section Contents

Related Content…

-

The RMD Advantage: A Smarter Strategy for Washington & Idaho Retirees

Required Minimum Distributions don’t have to be a burden. Learn how savvy Washington and Idaho retirees are transforming their RMDs into a powerful retirement advantage, potentially increasing income while maximizing tax-deferred…

-

The Pension Triple Play: A Washington Retiree’s Guide to Having it All

Learn how to maximize your Washington state pension income, protect your spouse’s future, and build family wealth through our innovative pension triple play strategy. Get 22% more monthly income on average.